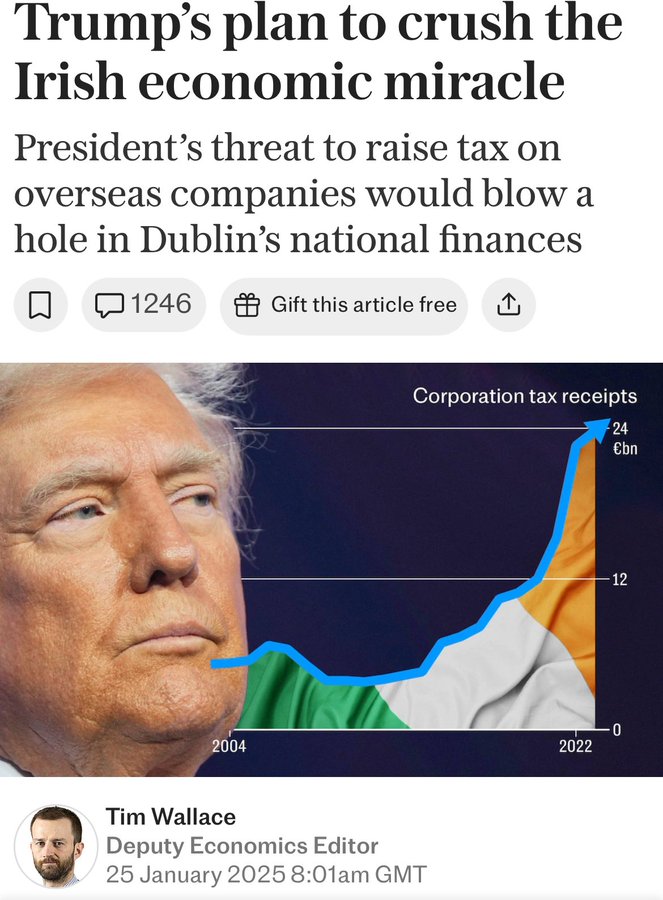

warning that Ireland’s golden goose of corporate tax receipts may be cooked Ireland offers an attractive corporate tax regime – headline rate: 12.5pc, first announced in 1997 – and offering incentives for investment Tax receipts have swollen raking in almost €24bn in 2023 – more than double the €10.4bn raised five years ago and more than five times 2013’s haul of €4.3bn The effects have been transformative National debt is plunging Spending is soaring The country is even piling money into a sovereign wealth fund National debt is plunging from more than 100pc of the size of the Irish economy a decade ago to around half with the country on track to be nearly debt-free by 2040 It has managed to achieve this with a domestic tax burden of less than 40pc compared to the UK which is facing its highest burden since WW2 However, storm clouds in the form of Howard Lutnick at the Trump admin are on the horizon He has said: “They make the parts in China, they put the parts together in Taiwan, then they wave their magic wand and it floats over Ireland – of course it floats over Ireland because that is where Apple does its parts – and it comes to America and they make something like 3pc profit in America.”

notes that much of the appeal of an Irish base was the ability to house a company’s intellectual property in Ireland which companies then attribute a significant share of global sales and profits to that IP and so pay the 12.5pc rate rather than a higher tax in the nation where sales are made Already Trump has Pulled America out of of the OECD deal to introduce a worldwide minimum corporate tax rate of 15pc which obliges Ireland to collect a top-up tax from US companies that declare a tax rate below 15pc from next year, setting Dublin on a collision course with Washingto Ordered an investigation into “whether any foreign country subjects United States citizens or corporations to discriminatory or extraterritorial taxes” Ireland has a huge tech and pharmaceutical base Apple has had a base in Cork for decades and employs 6,000 people Microsoft has 3,500 staff – not all in the Republic, for it has offices in Belfast as well as Dublin Google has 5,000 in Ireland Pfizer has 5,000 staff in Ireland working in manufacturing and in research and development Ireland exported €77bn of pharmaceutical and medical goods in 2023 In Trump’s first term he offered a form of amnesty to companies that had stashed an estimated $2 trillion offshore, allowing them to bring the cash home with tax rates well below the usual level of up to 35pc Trump also managed to move manufacturers away from China to Vietnam through punitive tariffs Could he do this to Dublin Time will tell